Expanding an e-commerce company into new markets can be a daunting task, especially when you have to navigate the complex world of VAT registration, VAT filings, and extended producer responsibility (EPR). With the right tools and a good support system, this can be made significantly easier. Staxxer provides a full solution that acts as a one stop shop for all of your VAT and EPR compliance requirements, providing seamless and efficient operations for e-commerce sellers in Europe.

The challenges of VAT compliance

The compliance with the Value Added tax (VAT), is among the most essential aspects of operating an online business in Europe. Each country has its own VAT laws. To ensure compliance, you must pay close attention to each and every aspect. Online retailers must be registered for VAT in each of the countries they sell to, submit regular VAT returns and make sure that the calculations are accurate for VAT due. It can be a lengthy process that is also prone to error, and takes precious resources away from the core business tasks.

Staxxer is your one-stop shop for VAT Compliance

Staxxer simplifies VAT compliance by providing an all-in-one solution for VAT registration and VAT filings. Staxxer’s automated procedures allow online sellers to concentrate their efforts on expanding and growing without the burden of administrative tasks. Staxxer’s VAT compliance is easy:

Automated Registration of VAT In the event of expanding into a market VAT registration is mandatory within the country. Staxxer handles the entire process of registration. This makes sure that the registration process is in the compliance with local laws, and removes the need to help businesses navigate complicated bureaucratic procedures.

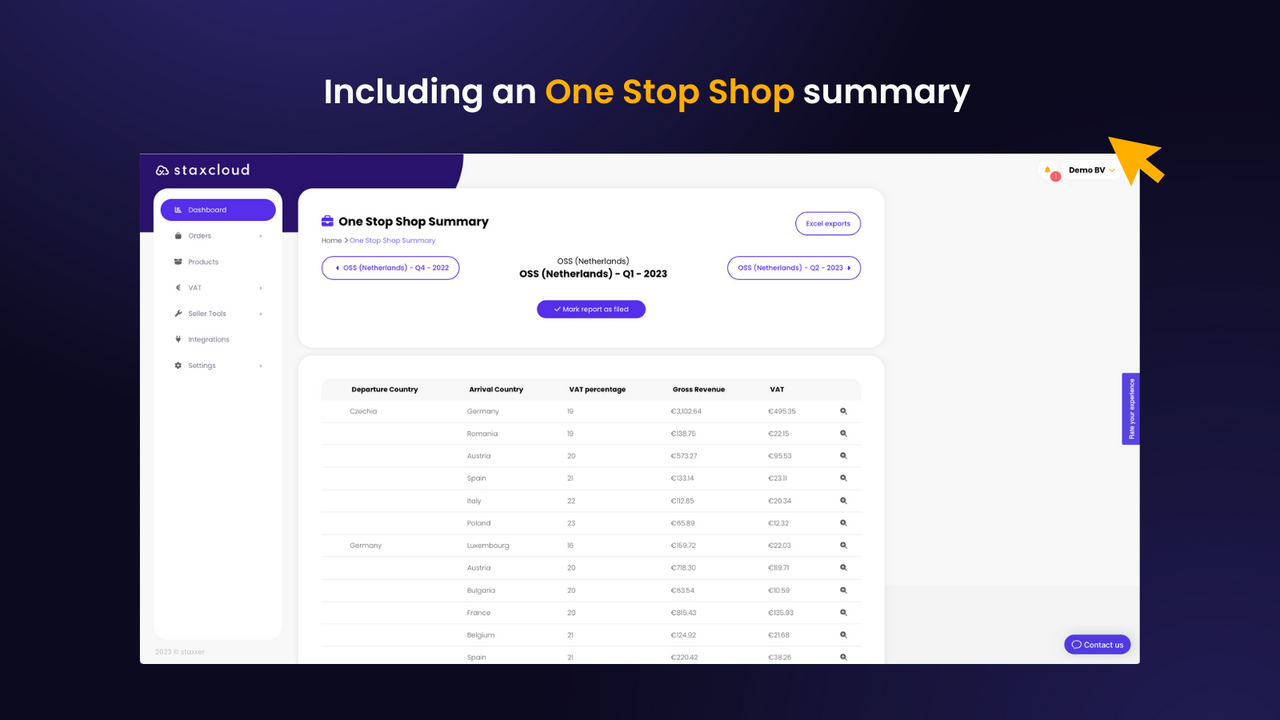

Effective VAT Files: Companies operating in Europe are required to regularly file VAT tax returns on a monthly basis. Staxxer simplifies the process of filing VAT, ensuring accurate and timely submissions. The platform consolidates all the data and connects sales channels to calculate the VAT due in each country up to the penny.

Staxxer offers a comprehensive VAT management system, from calculating VAT to processing declarations. Its end-to-end service ensures that businesses are compliant, without the need to dedicate considerable time or resources for VAT related tasks.

Role extended producer responsibility for the role

Extended Producer Responsibility (EPR) is an environmental policy approach that holds producers accountable for the entire lifecycle of their products including recycling and disposal. In the case of e-commerce companies this means that they must comply with laws governing packaging and electronic waste and other product-specific waste streams.

Staxxer’s EPR Solutions

Staxxer’s knowledge extends to EPR compliance too. Staxxer assists businesses with meeting their EPR obligations.

Automated EPR Compliance Staxxer’s platform integrates EPR Compliance in its offerings by automating reporting and managing waste requirements. It helps businesses adhere to environmental regulations, without adding another administrative burden.

Comprehensive Reporting: EPR requires detailed reporting about the kinds and amounts of waste produced. Staxxer’s software simplifies this process by consolidating data and generating exact reports, which ensures the compliance of local and international rules and regulations.

Sustainable Business Practices – Through effective management of EPR obligations, businesses are able to improve their sustainability efforts. Staxxer’s solutions can help businesses reduce their environmental impact as well as promote environmentally responsible production and disposal.

Why Entrepreneurs Choose Staxxer

Staxxer is an all-encompassing automated software that helps simplify VAT and EPR compliance for entrepreneurs as well as e-commerce companies. These are just a few of the major benefits:

Automating VAT filings as well as EPR Compliance allows businesses to concentrate to expand and grow. Staxxer solutions eliminate the need for manual data input and administrative tasks.

Staxxer’s platform provides accurate calculations to limit the risk of errors and penalties. The accuracy of the software is vital to maintain compliance and avoid costly mistakes.

Simple to Use Easy to Use: Staxxer’s user-friendly interface as well as its seamless integration with various sales channels makes it simple for companies to manage their VAT and EPR obligations. The intuitive interface of the platform simplifies complex processes to make compliance easy.

Staxxer’s VAT and EPR compliance allows firms to operate with peace and confidence, knowing all regulations are being met. Entrepreneurs looking to expand without having to worry about compliance will find this peace of mind invaluable.

Conclusion

Staxxer offers a single-stop solution for ecommerce businesses looking to make it easier for them to comply with VAT and EPR. Staxxer helps automate VAT registration, filings, and EPR obligations. This lets companies focus on expansion and growth. Staxxer’s extensive platform guarantees accuracy in calculation, prompt submission and long-term sustainability and makes it a perfect business partner for entrepreneurs looking to grow with ease. Staxxer provides a range of solutions that make compliance simple.