Are you an ecommerce business owner who is overwhelmed by all the financial responsibilities your business involves? The most crucial aspect that is key to success for any online store is having a bookkeeping process in place that accurately reports and follows through with every sale, each payment received, expenditures made and tax due. Bookkeeping can be useful in preparing accounts, submitting your taxes every year, or tracking the flow of cash.

Successful ecommerce businesses require more than just good products and good marketing strategies. Financial management is crucial to ensure compliance and profits. This article will focus on the key aspects of financial management for e-commerce, including accounting, taxation and bookkeeping. Knowing and understanding the fundamentals of e-commerce is critical to long-term growth and success.

Bookkeeping is the basis of sound financial management for online businesses. Bookkeeping involves organising and recording financial transactions such as sales and expenses. E-commerce entrepreneurs can gain insight into the financial condition of their company by keeping accurate and current books. They can keep track of the flow of cash and keep track of expenditures and sales. For more information, click tax preparation

Achieving effective bookkeeping procedures is vital for online businesses of all sizes. Here are some strategies that can help you streamline your bookkeeping.

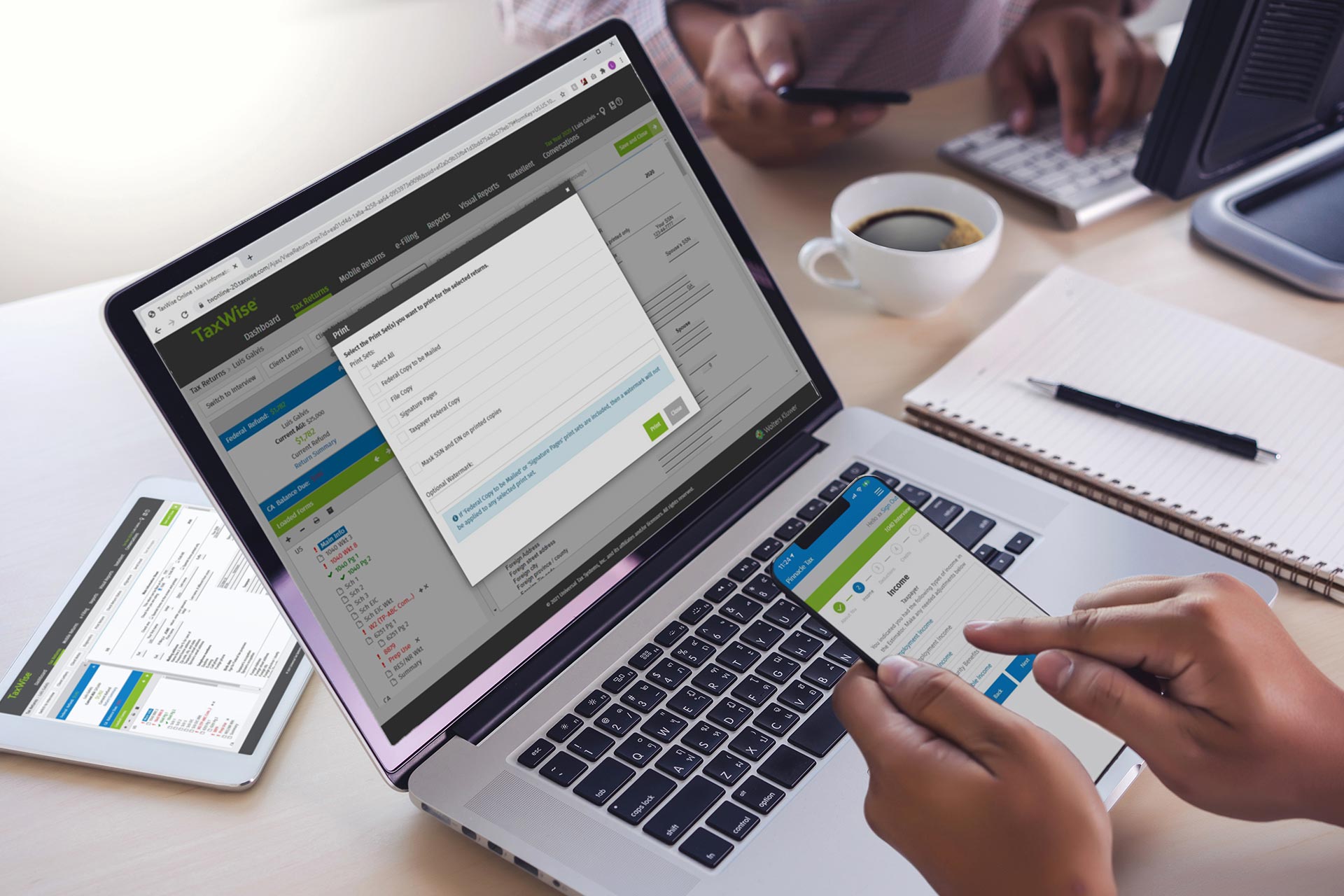

Utilize Accounting Software Get a reliable accounting software specifically designed for businesses that sell online. These tools make data entry easier as well as generate reports. They also provide integration with payment gateways, ecommerce platforms and ecommerce platforms.

Separate personal and business finance: It is essential to separate your account with a bank and credit card for your ecommerce business. This will streamline your bookkeeping, simplifies tax preparation, and provides accurate financial reports.

Classify transactions: By correctly classifying your transactions you can gain a better understanding of your revenue streams. Set up specific categories for sales advertising costs, shipping expenses, and any other relevant expense types.

Tax preparation is a critical element of managing the financials of an e-commerce business. Tax regulations must be followed by businesses that operate online, they must be able to collect and pay sales tax when necessary, and submit accurate tax returns. Take note of these aspects for efficient tax planning:

Sales Tax Compliance: Be aware of the requirements for sales tax in the jurisdictions where you market your goods. You need to determine whether you have nexus or a substantial presence within these states. If yes, you will have to pay sales tax and refund the tax.

Maintain detailed documentation. Keep meticulous records for all of your transactions, such as sales, tax payments, and expenses. Keep track of any exemptions and deductions that you may be entitled.

Get a Tax Professional’s advice Taxation for e-commerce can be complicated. Contact a tax professional that is knowledgeable about ecommerce to ensure that your tax returns are accurate and compliant.

Accounting extends beyond bookkeeping and tax preparation. It is the process of analyzing financial data as well as generating financial statements as well as providing a complete overview of your ecommerce business’s financial performance. Accounting is important because of a myriad of reasons.

Financial Analysis: Accounting lets you to gauge your company’s financial performance, determine trends and make educated choices about expansion.

Budgeting, Forecasting, and Financial Goals Accounting lets you develop budgets, set financial goals, as in forecasting future performance. This enables you to plan strategically and allocate resources effectively.

Financial Reporting: Generating financial statements such as balance sheets, income statements as well as cash flow statements allows you to communicate your business’s financial position to investors, stakeholders and lenders.

Accounting for complex financial issues becomes complicated as your business expands. outsourcing bookkeeping or accounting can provide a variety of benefits.

Expertise and accuracy Expertise and Accuracy: Bookkeepers and accountants who are professionals are experts in the field of e-commerce financials. They can ensure accurate accounting and financial reports.

Outsourcing can help you save time and money. It allows you to concentrate on your business’s core activities while professionals handle the financial aspects. Outsourcing can be cheaper than hiring staff in-house.

A well-organized bookkeeping system for your ecommerce store is crucial to ensure that to maximize your profit. It may seem overwhelming and time-consuming to maintain all the necessary records But a solid bookkeeping system will allow you to analyze expenses and gain insight into areas you can enhance efficiency and increase sales. An accounting professional will be able to assist in setting up a solid bookkeeping program that puts your business in the ideal position possible for continued success. If you’re feeling in a state of overwhelm or don’t have the necessary resources and need help, seek out assistance from a trusted service. This could open the door to numerous new possibilities that can help your business in a variety of ways now as well as in the future. Why wait then? Profit from these valuable assets and increase the profitability of your company today!